Best Personal Loan Options with Low Interest Rates

In today’s fast-paced financial world, personal loans have become one of the most reliable tools to manage urgent expenses, consolidate debt, or fund big life goals. However, the biggest concern for most borrowers is the interest rate. A high interest rate can double your repayment burden, while a low interest loan makes borrowing affordable and stress-free. If you are searching for the best personal loan options with low interest rates, here’s everything you need to know.

Why Low-Interest Personal Loans Matter

Personal loans are usually unsecured, meaning you don’t need to pledge collateral. Because of this, lenders charge higher rates compared to secured loans. But if you qualify for a loan with a low Annual Percentage Rate (APR), you save a significant amount over the repayment period. For example, even a 2–3% difference in rates can save you thousands of rupees or dollars in interest payments.

Factors That Influence Loan Interest Rates

Before choosing a lender, understand what affects the rate you are offered:

- Credit Score – A higher credit score (750+ in India or 700+ in the US) usually gets you lower rates.

- Income Level – Stable income reassures lenders and reduces risk.

- Loan Amount & Tenure – Shorter loan durations often come with lower interest rates.

- Lender Policies – Banks, credit unions, and online lenders all have different risk models.

Best Options for Low-Interest Personal Loans

Here are some reliable sources where you can find competitive rates:

1. Banks and Credit Unions

Traditional banks often provide personal loans to existing customers with attractive interest rates. Credit unions, on the other hand, usually offer lower APRs than banks and are a great choice if you are a member.

2. Online Lenders

Digital lending platforms have become popular for their fast approval and competitive rates. Many of them use advanced credit models, making it easier for borrowers with average credit scores to qualify at reasonable rates.

3. Peer-to-Peer (P2P) Lending Platforms

P2P platforms directly connect borrowers with individual investors. Since they eliminate middlemen, borrowers often secure lower rates compared to traditional lenders.

4. Balance Transfer Loans

If you already have a personal loan at a higher rate, you can refinance or transfer your balance to a lender offering lower interest. This strategy helps reduce long-term repayment costs.

Tips to Get the Best Low-Interest Loan

- Always compare multiple lenders before applying.

- Maintain a strong credit score and avoid missed payments.

- Borrow only the amount you truly need.

- Negotiate with lenders if you have a long banking relationship.

Conclusion

Personal loans can be a smart financial solution when used wisely, especially if you secure them at low interest rates. Whether you choose a traditional bank, credit union, or a modern online lender, always compare offers, check eligibility, and calculate total repayment before committing. With the right choice, a personal loan can help you meet your goals without becoming a financial burden.

Medium fade on the sides, longer on top with enough length to sweep back. Modern pompadour with texture, not too sleek

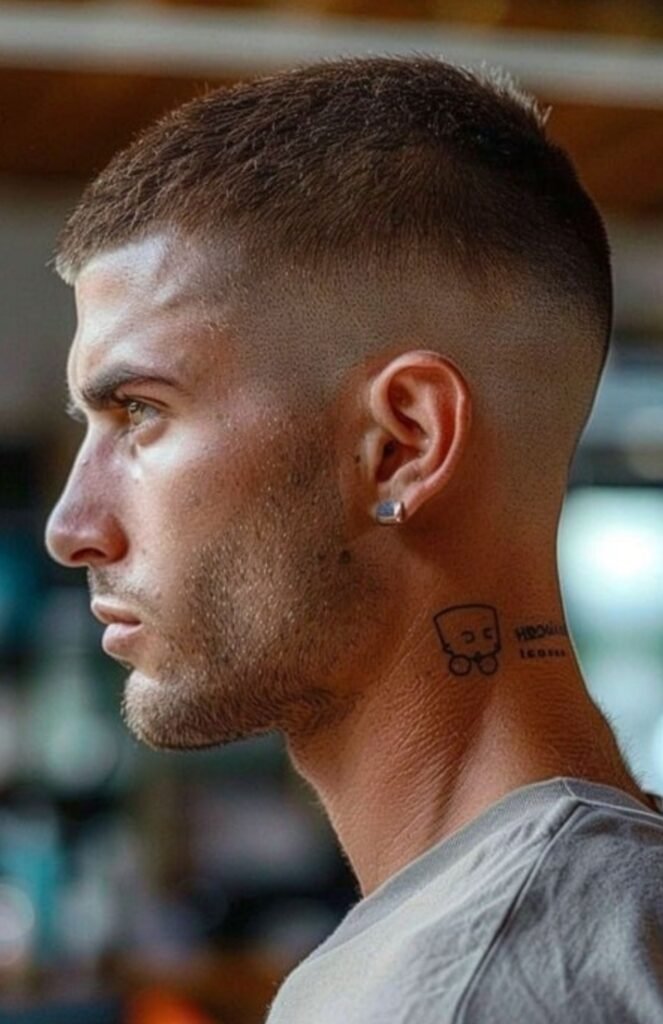

Classic crew cut with a medium-high fade and textured scissor work on top

Medium top, tapered sides, natural part-keep movement, not slicked.

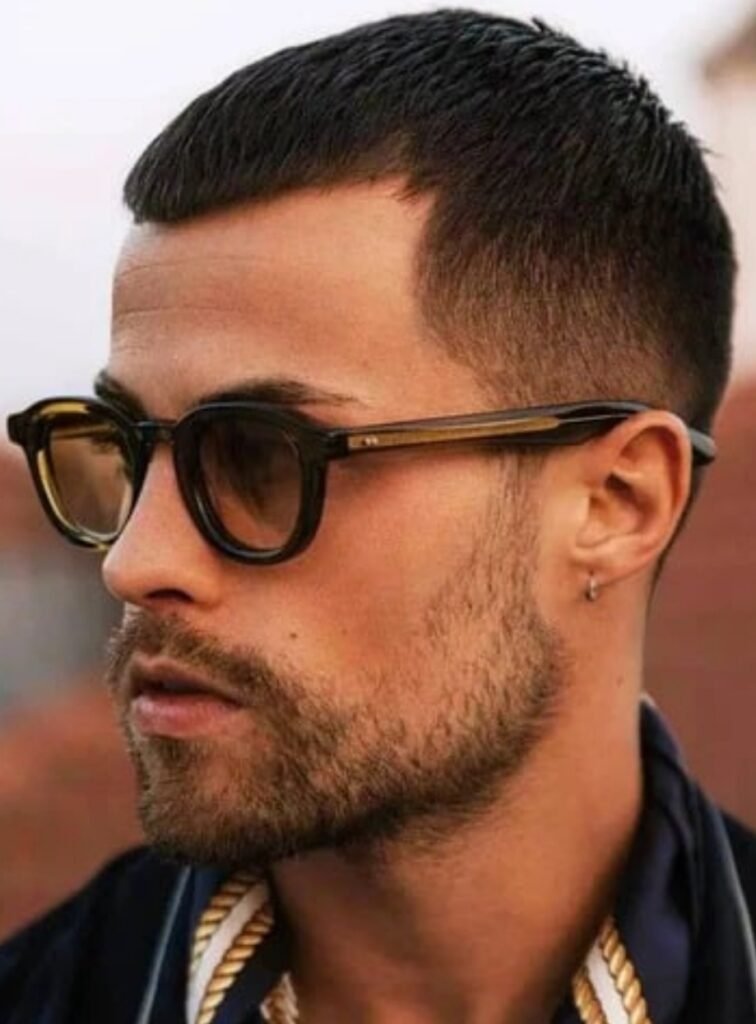

Graduated buzz cut: #2 on top blending to #1 on the sides with a soft fade.

Layered medium length with face-framing pieces; point-cut for texture so hair moves freely.

Longer top with textured layers, tapered sides; enough length to style upward/back with movementMore Cutting Photos Click : –

CLICK HERE